Hurricane Damage Insurance Claims in Florida

Most Florida homeowners’ insurance policies do contain coverage for hurricane-related damages. Even still, policyholders have to fight to recover rightfully owed insurance benefits allowable under their insurance policies, as insurance companies may be facing many other claims just like yours as a result of a similar weather event that could be costly. However, this does not mean that the insurance companies can unjustly deny or fail to adequately open coverage. Instead, the insurance companies should assist the homeowners with fixing their homes and property damage when the incurred damage is the result of an event that is covered under their applicable insurance policy. That is why KS Law Group, PLLC’s legal team is here to review your insurance policy with you and to help you retrieve the maximum amount of insurance benefits applicable to your property damage and specific situation.

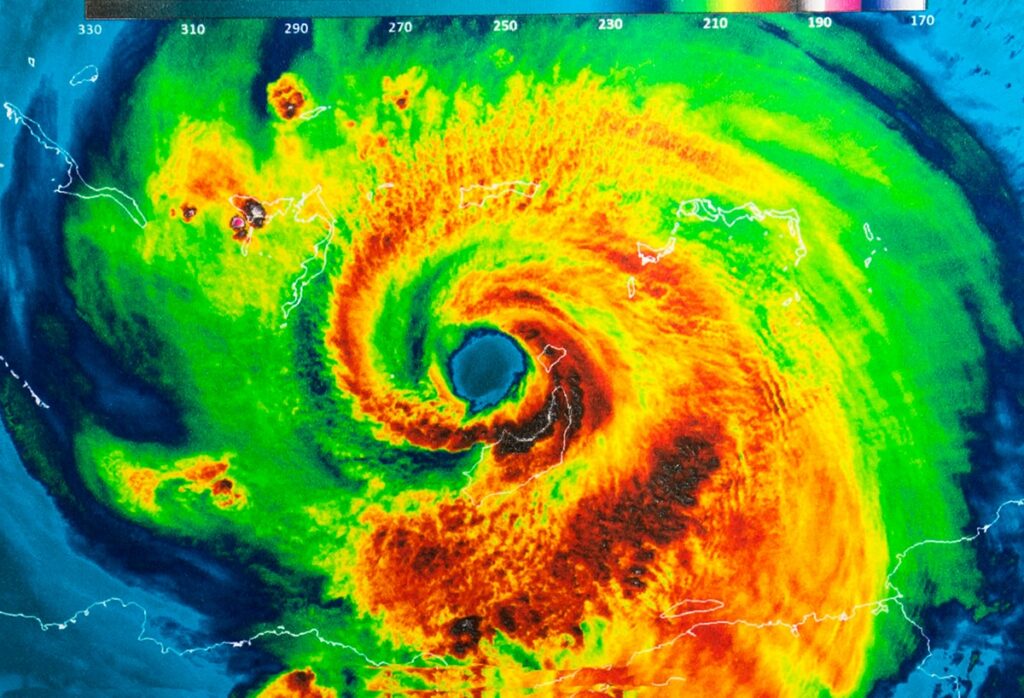

Dealing with Hurricanes and Tropical Storms in Florida

If your residential or commercial property was damaged due to a hurricane or a tropical storm, it’s important to file a claim with your insurance company in a timely manner. This allows you to minimize your out-of-pocket expenses for the necessary repairs to your property.

Most insurance policies have a limited time in which hurricane damage claims can be brought to the insurance company’s attention. The allowable timeframe may vary depending on the type of damage, when your property damage occurred, and which part of your property is damaged. As a result, your claim for property damages must be accurately made at the right time. We will help you navigate the claims process, even if your hurricane damage was previously denied or recently discovered.

KS Law Group, PLLC is here to keep a roof over your head. Like the foundation of your home, the roof is a key component to the structural integrity of the home, providing protection to you and your loved ones. Life gets busy and checking your roof is probably the last thing on your mind, especially in these busy and unprecedented times. Roof damage doesn’t always manifest itself in an obvious way. If not regularly inspected, you may not even know if you have wind or debris strike damage until you start to see water stains on the interior of your home. For your peace of mind, call our office today for a free inspection. Should you have qualifying damage, our legal team will thoroughly review your insurance policy and help you recover the maximum insurance benefits that you deserve.

HOW TO SUCCESSFULLY PREPARE AND FILE A HURRICANE INSURANCE CLAIM IN THE HEAT OF THE MOMENT

The extent of your hurricane-related property damage depends on various factors, including your location, the type of property involved, the degree of damage, and whether there have been any previous issues with the property.

Insurance policies that are offered to customers in specific hurricane-prone geographical regions might not initially offer hurricane-related coverage in their standard insurance policies. Additionally, some insurance companies may refuse to cover the full extent of the damage— especially if the damaged property is more towards the end of its lifecycle or there are outstanding pre-existing damages. These are just some of the issues that KS Law Group, PPLC can assist you with during the trying time when your property has been damaged by hurricane-driven wind and rain.

We know that when unexpected property damages occur, no one is ever fully prepared to deal with the cleanup, documentation, insurance company, inspections, and any necessary repairs or replacements. That is why KS Law Group, PLLC is prepared to provide you with the information that you need to correctly document your loss in preparation of starting the claims process.

Below is a step-by-step guide for your reference when faced with unforeseen property damages.

- Document the Condition of the Damaged Property: Take photos and videos of all damages to your property, personal belongings, and any other areas or items that have been affected by the damage. If you can, take an inventory of the damaged property by making a list of all of the property losses and damages for your records and possible future use.

- Limit Yourself to Temporary Repairs: If you have a viable insurance claim, and aside from emergency repairs listed above, make sure to avoid making unnecessary repairs before any inspections to your damaged property and until you hire a professional to assist you so that the full extent of the damage can be documented and inspected by professionals and your insurance agents.

- File Your Claim As Soon As Possible: Ensure that you, your family, and your property are safe and protected from the storm. As soon as you are able, or once the storm has passed, make sure that your representative or yourself contacts your insurance agent or insurance company to file a claim and timely report your property damages.

- Engage in Temporary Emergency Repairs or Mitigation Right Away if Necessary: If the damage is extreme, and/or rapidly continues to worsen, you may need a temporary emergency repair, prompt mitigation services, or to perform immediate mitigation to prevent further damage. If this is the case, please contact the legal professionals here at KS Law Group, PLLC right away for our advice so that we can walk you through the process of contacting a licensed contractor, restoration service, or mitigation company.

- Gather All Your Documentation: Get together all of the documentation that you have regarding your property damage including any photos, videos, lists, receipts, repair invoices, and your applicable insurance policy. Contact a professional that is experienced in property damage and insurance matters so that you can talk about the incident and make sure that all of your concerns are heard and your questions answered.

- Document the Condition of the Damaged Property: Take photos and videos of all damages to your property, personal belongings, and any other areas or items that have been affected by the damage. If you can, take an inventory of the damaged property by making a list of all of the property losses and damages for your records and possible future use.

- Engage in Temporary Emergency Repairs or Mitigation Right Away if Necessary: If the damage is extreme, and/or rapidly continues to worsen, you may need a temporary emergency repair, prompt mitigation services, or to perform immediate mitigation to prevent further damage. If this is the case, please contact the legal professionals here at KS Law Group, PLLC right away for our advice so that we can walk you through the process of contacting a licensed contractor, restoration service, or mitigation company.

- Limit Yourself to Temporary Repairs: If you have a viable insurance claim, and aside from emergency repairs listed above, make sure to avoid making unnecessary repairs before any inspections to your damaged property and until you hire a professional to assist you so that the full extent of the damage can be documented and inspected by professionals and your insurance agents.

- Gather All Your Documentation: Get together all of the documentation that you have regarding your property damage including any photos, videos, lists, receipts, repair invoices, and your applicable insurance policy. Contact a professional that is experienced in property damage and insurance matters so that you can talk about the incident and make sure that all of your concerns are heard and your questions answered.

- File Your Claim As Soon As Possible: Ensure that you, your family, and your property are safe and protected from the storm. As soon as you are able, or once the storm has passed, make sure that your representative or yourself contacts your insurance agent or insurance company to file a claim and timely report your property damages.

Remember that it is not only important to consult with professionals in the property damage and insurance industry, but it is imperative to retain qualified legal representation when your property and insurance benefits are on the line.

KS Law Group’s experienced team has filed countless hurricane and property damages claims on behalf of our clients in the toughest situations. KS Law Group, PLLC is here to make your hurricane-related insurance claim streamlined and easier for you.

Our office can not only assist you through the claims process, but our Florida insurance attorneys and legal staff are also well-versed in first-party insurance litigation. Should your claim be undervalued or denied, KS Law Group, PLLC will continue to pursue your matter to ensure you recover the insurance benefits that you need to bring your property back to its pre-loss condition.

Allow our office to assist you through the claims process by contacting our office today.

Why Choose KS Law Group, PLLC to Assist You

KS Law Group, PLLC is a trusted insurance law firm that caters to customers all around Florida. Our legal team has the knowledge and experience needed to guide you through a seamless claims process. Whether you are seeking assistance with your claim right from the start or your claim has already been reported, we will work with you through the entire hurricane-related insurance claims process.

We can also further assist you and provide additional legal assistance if your claim was underpaid or wrongfully denied. With KS Law Group, PLLC’s extensive experience in the insurance industry in Florida, and having worked with thousands of insurance claims and litigation cases, our firm is successful at rectifying insurance company’s delayed or wrongful claim decisions.

Regardless of whether your property damage is relatively recent or previously occurred, KS Law Group, PLLC’s experienced staff will review your matter and your insurance policy with you. Our office wants to ensure that your claim is handled accurately and fairly from start to finish.

Legal assistance and representation isn’t the only benefit you get out of working with KS Law Group, PLLC.

Our insurance law firm has a wide network of contacts including appraisers, contractors, and engineers who are available to inspect your property when needed. Sometimes, another set of eyes and maybe even a secondary inspection can assist further with determining the true cause of the damage, be able to provide a valuation of the damages and deliver additional insight as to the extent of the damage itself.

If you have a valid insurance claim, our office would strive to obtain the best-case scenario for you, starting with you limiting the initial upfront repair cost as much as possible to only emergency temporary repairs. This way, our clients are able to spend the least amount of initial out-of-pocket expense during the claims process and until there is a final resolution to your insurance matter. KS Law Group, PLLC’s main goal is for our office to work closely together with our clients, our clients’ contractors and other third parties, and the insurance companies to lead your insurance matter towards a successful and positive outcome.

If there’s something you want to clarify about your insurance policy, if you’re unsure about the coverage afforded under the current insurance policy, if you’re unsure about how much your deductible costs, or if you simply need a legal opinion on the claims process, let us know. Our team is always available for a free telephone or in-person consultation.

Schedule a Free Consultation

KS Law Group, PLLC will help you get the positive results you deserve from your hurricane damage insurance claim in Florida. Please contact our contingency-based insurance law firm today.